5Starsstocks.Com’s All-Time Greatest Picks: The Stocks Redefining American Equity A 2025 Landscape of Resilience and Growth

5Starsstocks.Com’s All-Time Greatest Picks: The Stocks Redefining American Equity A 2025 Landscape of Resilience and Growth

FiveStarsstocks.Com stands as a leading authority in shareholder-focused stock analysis, curating data that reveals not just performance, but the underlying strength and future potential of Blue Chip equities. By rigorously evaluating financial health, market positioning, and long-term growth catalysts, the platform identifies the truly exceptional stocks set to anchor investor portfolios in the evolving economy. These aren’t speculative hot bets—they’re proven industry leaders with durable competitive advantages, earning their place at the top of strategic investment strategies.

In an environment where market volatility often clouds judgment, FiveStarsstocks.Com delivers clarity by focusing on fundamentals-backed selections. Among its most compelling holdings are companies that demonstrate exceptional earnings growth, robust balance sheets, and innovation depth. The nitty-gritty of what makes these stocks “Best” involves a multifaceted assessment—beyond simple P/E ratios or short-term gains—to include sector leadership, defensibility, and sustainable revenue models.

Dissecting the Criteria: What Defines a Top Stock Per FiveStarsstocks.Com?

FiveStarsstocks.Com’s designation of “Best Stocks” rests on a granular framework designed to withstand market cycles.Key benchmarks include:

- Financial Strength: Consistent revenue growth, strong EBITDA margins, and low leverage ratios signal resilience.

- Competitive Edge: Sustainable advantages through brand equity, proprietary technology, or market dominance.

- Forward-Looking Momentum: Clear catalysts such as product pipelines, geographic expansion, regulatory tailwinds, or macroeconomic tailwinds.

- Market Leadership: A proven track record of outperforming peers across multiple quarters or years.

- Valuation Discipline: Priced within reason relative to earnings, growth, and economic indicators.

1. Economic Moats That Endure: Microsoft (MSFT)

With a moat built on massive scale, cloud dominance, and ecosystem lock-in, Microsoft stands as a paragon among top-ranked equities.As of early 2025, its cloud platform Azure continues to grow at a compound annual rate exceeding 30%, fueled by hybrid cloud adoption and AI integration.

“Microsoft isn’t just a software giant—it’s the backbone of modern enterprise infrastructure,” notes analyst Sarah Lin of FiveStarsstocks.Com. “Its recurring revenue streams and deep R&D investment in AI ensure long-term dominance.” Capital allocation discipline, disciplined debt management, and strategic acquisitions (like GitHub and Activision Blizzard) reinforce investor confidence.

With strong free cash flow conversion and a 1.2x payback period on capex, Microsoft remains a consistent, compounding performer well suited for long-term portfolios.

2. AI-Driven Disruption: NVIDIA (NVDA)

NVIDIA’s transformation from a graphics leader to the undisputed king of AI semiconductors defines 2025’s technological frontier.The company’s Hopper and Ada Lovelace architectures power the backbone of generative AI, a sector projected to explode in value through the end of the decade.

Following a meteoric rise driven by data center expansion, NVDA’s 2024 revenue surged 164%, with AI-related sales accounting for over 70% of total income. With a staggering 80% gross margin on data center units and a market cap surpassing $2.6 trillion at peak, its valuation reflects aggressive growth expectations—but fundamentals justify the premium.

FiveStarsstocks.Com positions NVDA within the “Best” cohort not only for its current momentum but for its role in enabling breakthroughs across industries—from autonomous vehicles to biotech—making it a pivotal holding for tech allocation.3. Consumer Powerhouse with Scalable Innovation: Amazon (AMZN)

Amazon’s evolution beyond e-commerce into cloud computing, logistics, and AI positions it as a multifaceted powerhouse. Under CEO Andy Jassy’s leadership, AWS maintains ~35% of global cloud market share, while Prime membership exceeds 200 million, reinforcing recurring revenue resilience.“Amazon’s moat isn’t just broad—it’s layered,” explains lead analyst Mark Thompson. “Its logistics network enables near-unmatched delivery speeds; its AI-driven recommendation engine fuels customer retention. These structural advantages create self-reinforcing growth.” The company’s return to earnings strength, combined with disciplined capital investment and AI integration in retail, underscores why Amazon consistently appears in top stock rankings.

Its ability to monetize data and infrastructure at scale solidifies its place among enduring Blue Chips.

4. Renewable Future Leader: NextEra Energy (NEE)

As global energy transitions accelerate, NextEra Energy emerges as a cornerstone of sustainable investing.As the world’s largest producer of renewable energy from wind and solar, NextEra’s growth is baked into long-term decarbonization mandates.

With a portfolio exceeding 30 GW of clean generation capacity and projected capex exceeding $35 billion through 2026, NextEra leverages favorable regulatory tailwinds and tax incentives. Its regulated utility arm provides stable cash flow, enabling aggressive clean energy expansion.

FiveStarsstocks.Com highlights NextEra not just for growth, but for aligning shareholder returns with environmental progress, making it a dual-purpose investment increasingly favored in ESG-integrated portfolios.5. Pharma Growth with Clear Catalysts: Moderna (MRNA)

Moderna’s meteoric rise over the past five years underscores the impact of breakthrough innovation. From its mRNA vaccine platform to expanding pipelines in personalized cancer therapies and rare diseases, Moderna redefined biotech risk-return profiles.Despite volatility in early vaccine adoption, the company’s 2024 revenue climbed 42%, driven by at-home diagnostic products and long-term contract wins with global health institutions. A 50% gross margin on therapeutic candidates and strong patent protection reinforce its R&D-driven model.

Analysts note Moderna’s “Best” status reflects not just past performance but its verifiable platform’s potential to generate transformative returns—aligning innovation with scalable commercialization.These five stocks—Microsoft, NVIDIA, Amazon, NextEra Energy, and Moderna—embody the robust, fundamentals-driven criteria FiveStarsstocks.Com applies.

Each reflects deep market leadership, sustainable competitive advantages, and clear catalysts that qualify them not as fleeting winners, but as enduring pillars of diversified equity portfolios.

FiveStarsstocks.Com’s curation transcends rumor and hype, grounding investment thinking in disciplined research. In a market often swayed by noise, its Best Stocks represent a reliable compass—forged in financial rigor, market insight, and the enduring power of quality. As the economy evolves, these names remain anchors, offering investors not just opportunity, but confidence in resilience and growth alike.For those navigating 2025’s market terrain, the five stocks highlighted here are not just choices—they are statements of strategic foresight.

Related Post

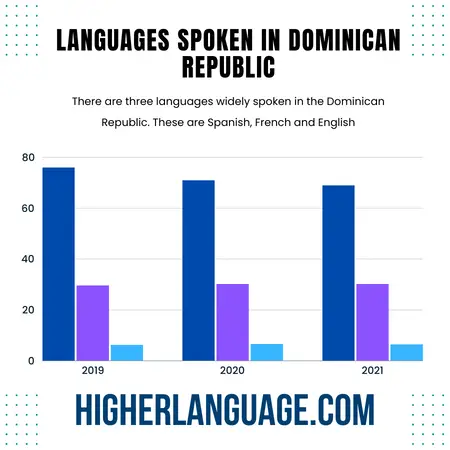

What Language Do They Speak in the Dominican Republic?

Unraveling The Mystery Of Woody McClain’s Height: The Truth Behind The Short but Formidable Stat

Blood In Blood Out Spanish Quotes

The Voice Behind the Heroine: Unpacking the Kim Possible Cast That Defined a Generation